Inflation and You

Boring monetary policy discussion made.......very slightly less boring

We don’t think of it very often, but the value of the dollar is half of nearly every transaction we make. Either we’re buying goods and services WITH dollars, or we’re selling our services (generally at work) FOR dollars. It’s a little strange to think about, but dollars are just as subject to the laws of supply and demand as anything else. When we create new dollars and add them to the money supply, existing dollars become devalued because more dollars are chasing the same amount of goods and services. This is how DuckTales taught an entire generation to think of inflation.

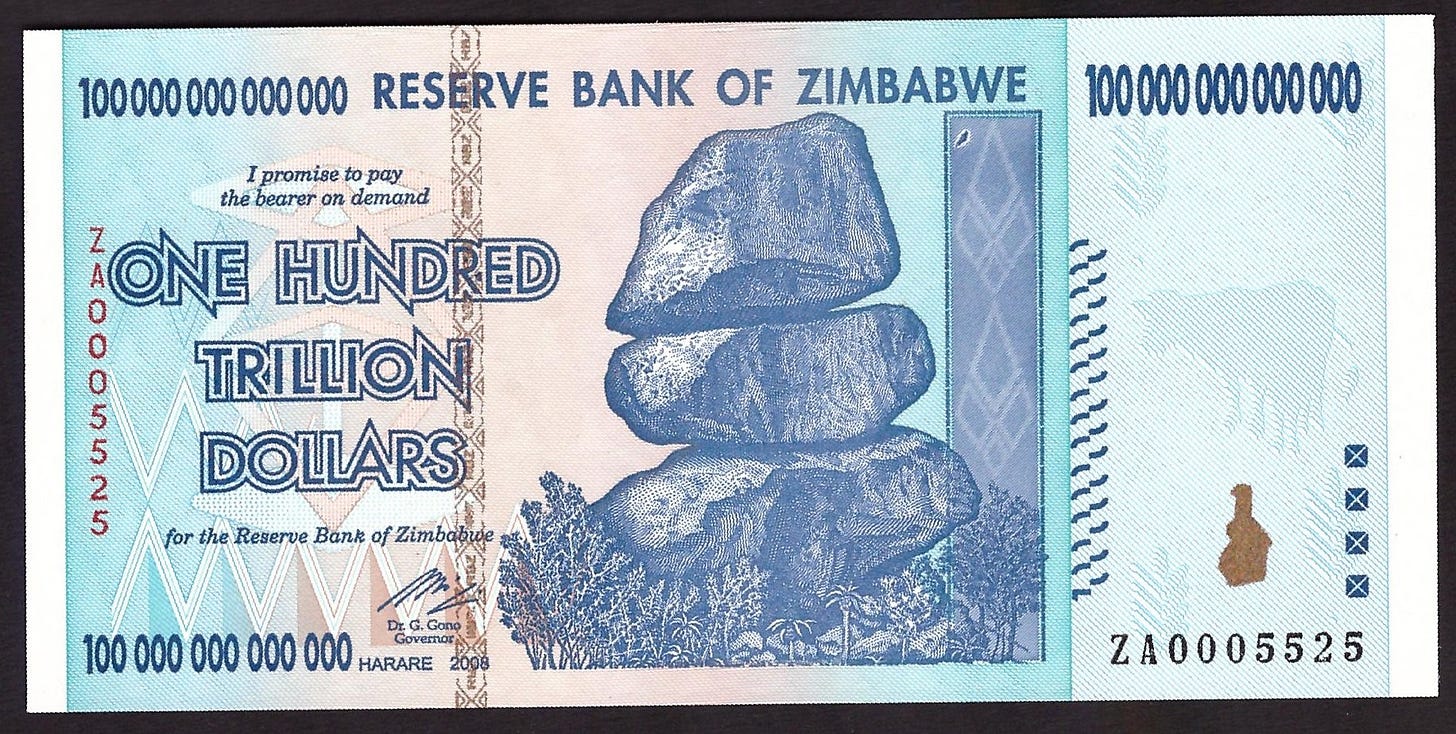

It’s a pretty solid answer to the question all children have: “Why not just give everybody a million dollars?” When everybody has a million dollars, nobody does. And if you do it anyway, soon your money looks like this:

When issued in 2008, this baby was worth roughly 40 cents. Ironically, Zimbabwe has since declared the US dollar its currency, stabilizing their economy, and these old notes are now fetching roughly $200 each.

“It was terrible. You’d have to pay for your coffee before you drank it because if you waited the cost would rise within minutes,” said businessman Shingi Minyeza, chairman of Vinal Investments.

Stories at the time circulated of people who went to work at the ‘days wage’, got paid that same day, and were unable to use their wages to afford bus fare home from work. That’s how fast inflation was killing Zimbabwe.

This is an extreme example, but the laws of economics apply everywhere. Including inflation. Just ask Venezuela.

One of the biggest, and one of the oldest, taxes is inflation. Governments have stolen their people’s resources this way, not just for centuries, but for thousands of years.

When speaking of inflation, I think it’s best to do it in two different terms: Monetary inflation, which is a rise in the money supply (the DuckTales scenario), and price inflation, which is a rise in prices. Though intertwined, these things are quite different.

First, monetary inflation. This is a pretty basic measurement. How many dollars are floating around out there?

As you can see, monetary inflation has been increasing and accelerating since Nixon went ‘full fiat’ in the 1970s. Since then, the number of dollars in the system has been doubling about every 11 years, with covid rapidly accelerating that trend.

How well did this speech hold up? Did going completely off the gold standard and allowing bankers and politicians to always print help ‘the working man’? Is your dollar ‘worth just as much today as it was yesterday’?

This is why the founders wrote in the Constitution that only gold and silver shall be money. They had first-hand experience about the dangers of paper money, thanks to the collapse of the Continental Dollar. They knew the politicians would ALWAYS find an excuse to print, and that citizens would be the ones holding the bag via devaluation of their savings and labor. (There would be winners, though! The people close to those who run the literal money-making machine ALWAYS do well.)

Price inflation is often related to and affected by monetary inflation, though MANY additional factors impact price inflation. A shortage of goods, additional cost of links in the supply chain, rising labor costs, and additional regulations all negatively affect price inflation. On the other side of the equation, improved efficiency, cheaper materials, reduced regulations, or increased automation tend to drive prices down (though rarely enough to actually see price decreases).

In addition, thanks to the Petrodollar, we’re able to ‘export’ some of our inflation to other countries, who need to hold US dollars to buy oil. (Just imagine being one of those suckers being forced to hold a devaluing currency just because you want to buy stuff with it!!!) This, along with some good old-fashioned juking the stats, is why the rate of monetary inflation rarely matches the ‘end’ rate of price inflation.

In a way, monetary inflation provides a sort of ‘baseline’ price inflation rate to the economy. Think of it as a wave pool with variable settings. At a low rate of monetary inflation, it’s easy to move. The higher the rate, the more you have to ‘fight’ to move forward. Set the machine too high and you’ll be overcome. Monetary inflation is the ‘rising tide’ that lifts all prices.

We tend run into huge problems when monetary inflation is increasing quickly and the number of goods and services in the economy is not. I’m guessing those of you old enough to remember the Jimmy Carter years remember stagflation.

Stagflation is an economic event in which the inflation rate is high, economic growth rate slows, and unemployment remains steadily high.

Sound familiar? This is exactly what the government’s response to covid (not covid itself) created. They flooded the country with dollars while also shutting down places that actually create the goods needed to grow. Now even the zoned-out are noticing prices rise extremely quickly. And once the fake economy of being close to the people running the money-making machine overtakes the real economy of voluntarily providing goods and services, the wheels come off the bus.

Unfortunately for us, Joe Biden has a plan to tackle inflation. He wants to print and spent trillions MORE dollars so that you pay ‘less’ for stuff like drug prescriptions or child care! Remember how Obamacare was going to save you money on healthcare costs but you never actually saw any savings? We’re going to take that ‘efficiency’ and spread it out to MORE places! He wants to crank that wave machine up to 11, and he claims this will LOWER inflation. But it will do the opposite.

‘United wishes and good will cannot overcome brute facts. Truth is incontrovertible. Panic may resent it. Ignorance may deride it. Malice may distort it. But there it is.’

Winston Churchill

This is a major problem for the Biden administration in particular and way too many of our current ‘leaders’ in general (and by extension the rest of us). They believe something is true, and think that strong enough belief will conjure it into reality. So they spend millions on the homeless in Seattle and don’t make the problem any better. They dole out millions to schools to ‘safely open’ when schools never needed to be closed in the first place. Billions get spent on high-speed rail, only for the cost to continue to climb while still having no high-speed service. No matter! They will throw good money after bad! After all, if they stop spending money, they might have to return some of that cash. Better to light it on fire!

With regards to inflation, the Biden administration first claimed that the problem was temporary. Then they shifted the to blame ‘greedy’ businesses (who all decided to get greedy at the same time, I guess?), an excuse that continues today. He’s still fighting to pass multi-trillion dollar bills, claiming they won’t add to inflation — while admitting Americans are already getting ‘clobbered’ by it. There’s simply no admission — or even the inkling of one — that terrible monetary policies over the last couple years are to blame.

Rest assured, whatever Biden and his team come up with, it will work just as well as everything else the government has touched in the last…….well, my whole lifetime. Meanwhile, the answer to getting inflation under control is staring us in the face: Remove the barriers we’ve placed in front of the economy. Dismantle all the stupid covid rules. Hire back the people who were fired (if they will have you). Stop Congress from spending so much money every year. And above all, stop creating so many dollars out of thin air!

And do it quick, before the situation calls for a modern-day Paul Volker to jack up interest rates into double digits.

Sadly, because this strategy doesn’t increase the power of the politicians, they’ll try everything else first. The can deny, deflect, and blame others, but in the end, there reality is: staring us all in the face.

Note: This is written from the viewpoint of Austrian economics, which many people with very impressive-sounding degrees will tell you is wildly wrong. If you read some of the links interspersed throughout the links, you can hear from the 'experts' on the other side (they're the ones saying there'll be no inflation just because we printed a bunch of cash).

https://mises.org/what-austrian-economics

I’m from Venezuela originally, moved to Houston on Dec 2000 and became an American citizen in 2013. I’m very grateful to this beautiful country and its people for the opportunity to work and raise our children here. I love the USA as much as I love Venezuela. What’s going on right now here is heart braking to say the least, all I can say is we have to fight it, there’s no other option, we can’t not let it happen here. I’ve been very vocal about it to all our friends, I’ve explained how I noticed that our schools here push the romanticizing of socialism every where they can, how our youth is being brain washed in academia right in front of us all while we ourselves finance this none sense. I just can’t believe it is happening all over again and that there’s still people with their heads buried in the sand worrying about the wrong stuff.

Your article is spot on!👍🏻